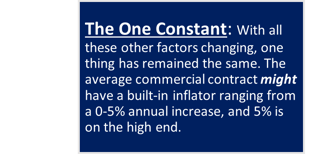

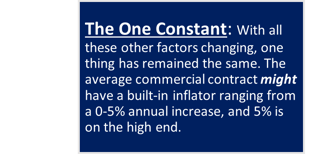

In healthcare today, charges are increasing, reimbursement is tightening, and pricing has become available for the public. Charges must be simplistic and straightforward for consumers to understand. Headlines highlight patients receiving astronomical bills for services rendered – causing an uproar. Bad press and negative views toward the way that healthcare charging is omnipresent. Providers must work to strike a balance between setting up market and consumer-friendly pricing and making sure that prices are in sync with their payor contracts to avoid leaving money on the table.

New Obstacles

To further complicate matters, costs for labor have increased significantly. At the same time, volume and staffing have decreased. Hospitals need to do more with less today. Because of the increase in patient pay responsibilities, the need for price transparency and upfront discussions regarding the cost of services is daunting.

the need for price transparency and upfront discussions regarding the cost of services is daunting.

Negotiations to Achieve More than Better Rates

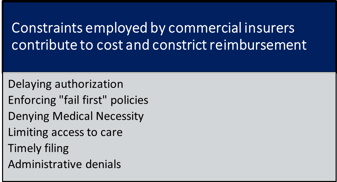

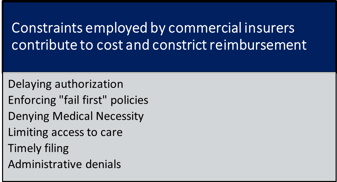

The American Hospital Association discusses some very poignant matters in the article Commercial Insurer Policies That Can Compromise Patient Safety and Raise Costs Must End when it comes time to think about what the cost of commercial contracts are incurring beyond simply the fee schedule rate reviewed at the table.

Several factors dictated by payment end up elongating a patient's journey, inflating their cost of care, and potentially denying services that their physician would deem medically necessary.

Where to Start?

Evaluate current prices to ensure accordance with the desired payor rates. If prices are consistently below commercial fee schedule rates, it considerably weakens the negotiating position when seeking an increase.

Price vs. Commercial Rates

- Are service charges below the current negotiated reimbursement rates?

- How does each payor benchmark against Medicare?

- Are service charges below wage-adjusted Medicare reimbursement rates?

- Is there room in the budget to increase charges beyond the maximum negotiated reimbursement rates?

Price vs. Market

- Do prices align with the expected market position?

- Are specific services priced in excess or well below market average?

- Does adjustment to increase charges above maximum negotiated reimbursement rates maintain or achieve the desired market presence?

This exercise may reveal pockets of services where negotiated price reductions can serve as a trade-off for increases in others to compete within your market.

Create The Roadmap

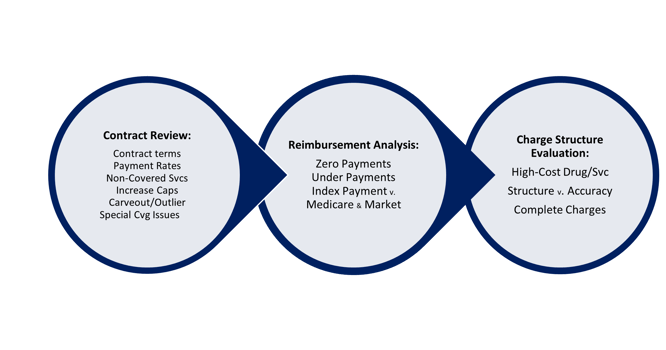

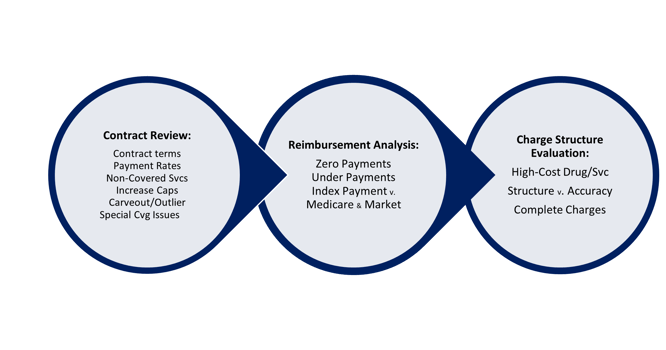

Review and analyze Payor Contracts, Charge Structure, and 835 Data to construct a roadmap to safeguard Net Revenue and a playbook to engage in contract negotiations.

The Negotiation Table

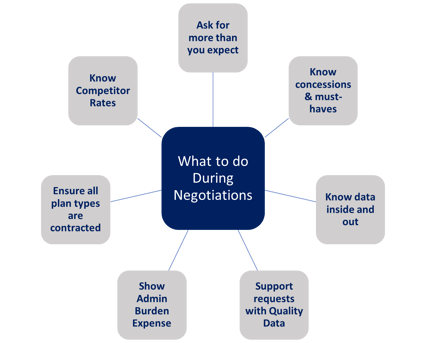

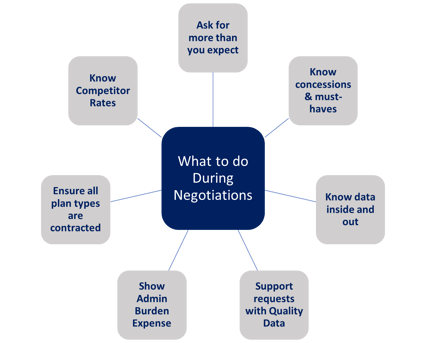

Once you have determined the priority for negotiations

and contacted your payor representatives to engage in negotiations, your strategy must be ready to go. The

key to a successful negotiation is understanding what to expect and preparing for adjustments. Before

entering into your discussions, know your data.  Model scenarios in advance, and understand which concessions

Model scenarios in advance, and understand which concessions

you may consider and which are "no-go’s”. Have a strong understanding of your competitor rates and

how your quality of care and cost of care measures against those in your market. Use this information for leverage in key services.

How to Succeed?

In order to be successful with your payor contract negotiations, you have to START. Begin by assessing your current contract rates and dates of last negotiation and create a plan to determine which payors to target. Once you have decided that you need to start, create a revenue integrity team, or tap your current team to begin the following processes:

Payor Contract Negotiation Preparation

- Measure Price Levels and Perform Market Analysis

- Create a Process for Monitoring Payors

- Identify Non-Price Payment Impacts

- Prioritize Payors to Renegotiate

- Initiate Communication with Payors

- Analyze Data to Know What to ask for

- Involve Legal Department on Contract Language (as needed)

- Assess Internal Resources vs. External Needs

MedCom is here to help.

At MedCom, we understand that many providers simply don't have the time or resources to perform the necessary analyses for successful payor contract discussions and negotiations. Let us be your experts at the negotiation table.

MedCom Solutions provides a unique combination of clinical expertise and proprietary technology to help medical service providers meet rapidly escalating and changing medical billing demands. We can help you evaluate key operational processes that impact Payor Contract Management, Payor Contract Analysis, Charge Master/Pricing Assessment, Implant Charge Capture, and 837/835 Payment Analysis.

For nearly 40 years, our Chargemaster, Pricing, and Compliance solutions have yielded hundreds of millions in net revenue for healthcare providers across the country.

Learn more about our solutions or visit our homepage and contact us today!

the need for price transparency and upfront discussions regarding the cost of services is daunting.

the need for price transparency and upfront discussions regarding the cost of services is daunting.

Model scenarios in advance, and understand which concessions

Model scenarios in advance, and understand which concessions